The AR/VR market is currently experiencing a decline, with recent data from IDC showing a drop in headset shipments. In Q2 2024, AR and VR headset shipments fell by 28.1% year-over-year to 1.1 million units. This decline is expected to continue throughout 2024, with full-year shipments projected to decrease by 1.5%. Despite this, industry analysts remain optimistic about the future, predicting a strong rebound driven by technological advancements, new product launches, and the emergence of mixed reality and extended reality.

Although challenges remain, the long-term growth trajectory of the AR/VR market appears promising, with IDC forecasting significant expansion in the coming years. The current slump in the AR/VR market is expected to be temporary, with IDC forecasting a rebound in 2024 of 46.8% year-over-year growth. This upturn will be driven by new hardware from major players like Meta and ByteDance. The introduction of Apple’s Vision Pro is also set to boost the market. Despite the short-term setback, the long-term outlook for AR/VR remains strong.

IDC predicts the industry will grow from 6.7 million units in 2024 to 22.9 million in 2028, representing a compound annual growth rate of 36.3%. Mixed reality devices are expected to lead the charge, making up over 70% of the volume by 2028.

AR/VR Market: Navigating a Dip Before the Boom

Recent Decline in Shipments

According to the latest data from IDC, worldwide shipments of augmented reality (AR) and virtual reality (VR) headsets experienced a noticeable dip in the second quarter of 2024. Shipments fell by 28.1% compared to the same period last year, totaling 1.1 million units. This downward trend isn’t entirely surprising, as it follows a similar pattern observed earlier this year.

Factors Contributing to the Decline

Several factors have likely contributed to this recent downturn:

- Economic Slowdown: The global economic climate has undoubtedly played a role, as consumers and businesses tighten their budgets and prioritize essential spending.

- Price Sensitivity: The relatively high cost of entry for many AR/VR headsets remains a barrier for widespread adoption. Consumers are often hesitant to invest in expensive technology, especially in uncertain economic times.

- Lack of Compelling Content: While the gaming and entertainment sectors have embraced AR/VR to some extent, the availability of truly compelling content and applications across various domains remains somewhat limited.

- Maturing Technology: As the AR/VR market matures, consumers may be adopting a “wait-and-see” approach, anticipating more advanced and affordable devices in the near future.

Reasons for Optimism: A Projected Rebound

Despite the current dip, IDC remains optimistic about the future of the AR/VR market. They forecast a 7.5% growth in headset shipments for the full year 2024, followed by a significant surge of 41.4% in 2025. This projected rebound is based on several key factors:

- Technological Advancements: Ongoing innovations in display technology, tracking systems, and processing power promise to deliver more immersive and compelling AR/VR experiences.

- New Product Launches: Anticipated releases of new headsets from major players like Apple, Meta, and ByteDance are expected to inject fresh excitement and drive adoption.

- Emerging Categories: The rise of mixed reality (MR) and extended reality (ER) headsets is expected to open up new possibilities and attract a wider range of users.

- Price Reductions: As technology matures and competition intensifies, prices are likely to become more attractive, making AR/VR accessible to a broader audience.

Mixed Reality to Dominate

IDC predicts that mixed reality headsets, which blend elements of both AR and VR, will become the dominant category, capturing over 70% of the market share by 2028. MR’s ability to seamlessly merge the real and virtual worlds offers a more versatile and immersive experience compared to standalone AR or VR devices.

Extended Reality on the Rise

Extended reality headsets, which typically provide a simple heads-up display or content mirroring, are also poised for growth. IDC expects ER headsets to capture over 25% of the market by 2028, driven by their affordability and increasing use cases in various industries.

Long-Term Growth Trajectory

Taking a long-term view, IDC anticipates the AR/VR industry to grow from 6.7 million units shipped in 2024 to 22.9 million in 2028, with a compound annual growth rate (CAGR) of 36.3%. This indicates a strong belief in the potential of AR/VR to become a mainstream technology in the coming years.

Table: AR/VR Headset Market Forecast (IDC)

| Year | Units Shipped (Millions) | Growth (%) |

|---|---|---|

| 2024 | 6.7 | 7.5 |

| 2025 | 9.5 | 41.4 |

| 2028 | 22.9 | – |

| CAGR (2024-2028) | – | 36.3 |

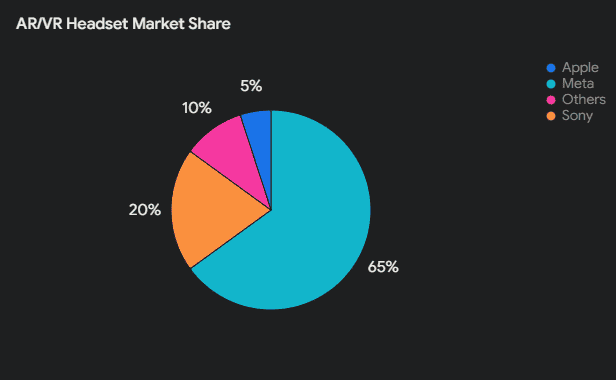

AR/VR Market Share By Manufacturer

| Brand | Market Share (%) | Major Models |

|---|---|---|

| Meta | 65 | Quest 2, Quest 3 |

| Sony | 20 | PlayStation VR2 |

| Apple | 5 | Vision Pro |

| Others | 10 | Pico 4, XREAL Air |

Key Takeaways

- AR/VR headset shipments dropped 28.1% in Q2 2024, with further decline expected this year

- A market rebound is forecast for 2024, driven by new hardware releases from major tech companies

- Long-term growth looks promising, with shipments projected to reach 22.9 million units by 2028

Analysis of the AR/VR Market in Q2 2024

The AR/VR market experienced a notable decline in Q2 2024. Several factors influenced this downturn, including economic pressures and shifting consumer preferences.

IDC Data Overview

IDC reported a significant drop in global AR/VR headset shipments for Q2 2024. The market saw a 67.4% year-over-year decline in the first quarter. This trend continued into Q2, reflecting ongoing challenges in the industry.

Total shipments for 2024 are projected to reach 6.7 million units. This figure marks a decrease from previous years. The average selling price (ASP) of devices also saw changes during this period.

Mixed Reality (MR) devices showed promise despite the overall decline. They are expected to lead the market by 2028, representing over 70% of the volume.

Factors Contributing to Market Dynamics

Economic uncertainty played a key role in the Q2 2024 market decline. Consumers became more cautious with spending on non-essential tech products. This led to reduced demand for AR/VR headsets.

The industry is in transition, moving towards new device categories. This shift caused some buyers to delay purchases. They are waiting for next-generation products with improved features.

ASP erosion affected market value. Manufacturers lowered prices to stimulate sales in a competitive landscape. This strategy impacted overall revenue figures for the quarter.

Despite short-term challenges, IDC forecasts long-term growth. The market is expected to reach 22.9 million units by 2028. This represents a compound annual growth rate (CAGR) of 36.3%.